A warranty is "contract" or claim between the consumer and the manufacturer that the purchased product from said manufacturer will be free of defects in materials and workmanship or it will be replaced within a period of time. Most manufacturers offer a 1 year (12-months) [limited] Warranty which vary according to jurisdiction, but commonly new goods are sold with implied warranty that the goods are as advertised.

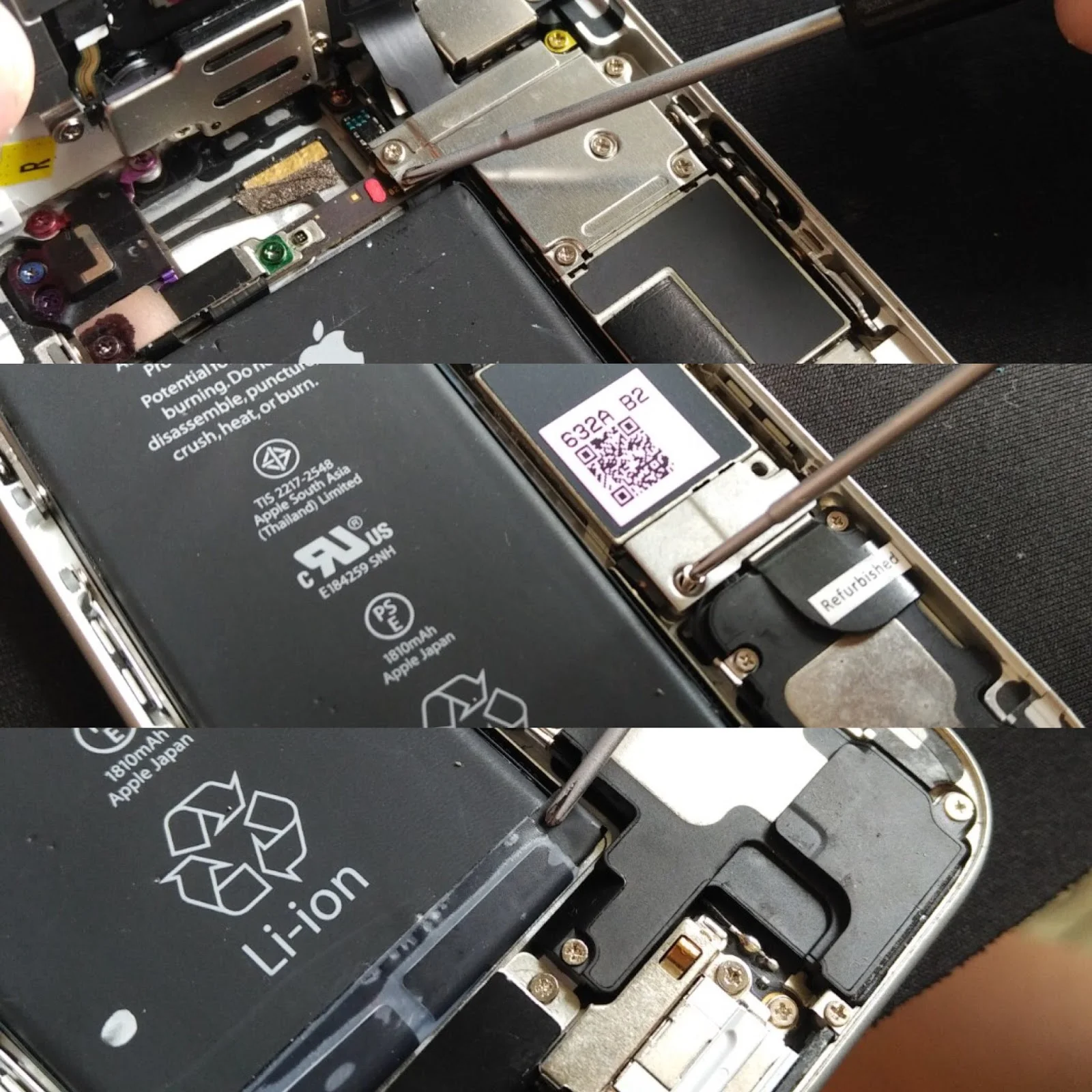

Read MoreThe promise of phone insurance and the reality of it are vastly different. Most people seem to think that if they “break” their phone the insurance is there to replace it with a brand new one. For some, a “broken phone” is really just a shattered screen that could have been replaced at a repair shop for about $100, but instead they send it off to Asurion and have their phone (that had a perfectly functional motherboard and had never seen a drop of water) replaced with a “Refurbished by Asurion” phone whose mobo was shoddily repaired after liquid damage by a half-rate technician contracted by the company to mass repair boards collected from other phones sent to the company from customers that don’t really seem to understand what their phone is worth.

Read More